Increased Economic Uncertainty Boost Demand for Hard Assets

1. Introduction

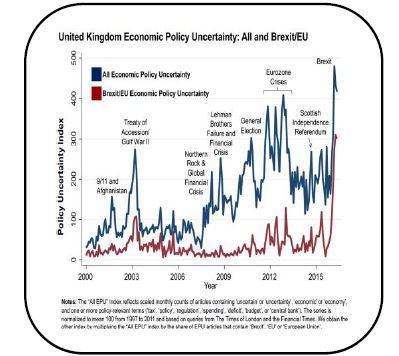

Figure 1: The Global Uncertainty index Reflects Economic Volatility

The entire world simply seems to be falling apart at the seams. Recently released Global Uncertainty Index (GNI)â, a measurement of unpredictability in over 20 countries, have already reached dangerous levels in 2019 and forecasted to be the biggest risk for future global growth (refer Figure 1 above)

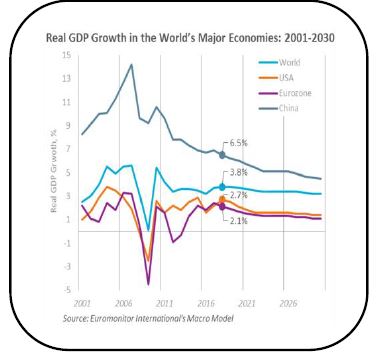

Figure 2: Weak Eurozone Economic Growth

Among the factors that have caused global economic uncertainty to spiral out of control includes the on-going trade tension between the US and China, the slowdown in several eurozone countries such as Germany, France and Italy have further exacerbated the severity of uncertainty (refer Figure 2). In nutshell, just look at what's going on all at once:

- A looming Brexit chaos

- Trump and his trade wars.

- The brewing European banking meltdown.

- Geopolitical tension across various regions

2. A Storm in Brewing

However, the irony is none of these reasons mentioned are new. What is new is the geopolitical environment getting worse, while the long-term debt-cycle bubble is set to burst at any moment. However, the impact on the global economy is predicted to be far more severe than the 2008 financial crisis

Meanwhile, in Europe, social democracy gradually has more or less lost its appeal while far-right populist regimes are gaining traction among the youth across major European nations such as Germany has further intensified the level of economic uncertainty. In the past, these political parties were originally considered fringe movements but now gained prominence among mainstream s as people become angry and demand an alternative to the âstatus quoâ.

The simple question that people are asking when they vote for populists is âWhat about me?â The answer, regardless of whether that administration is left or right leaning, is âHere, have some money. Though fiscal stimulus is growing in popularity all over the world the reality is that the Quantitative Easing (QE) has failed and not delivered the kind of economic growth everyone was hoping for.

Instead, the hidden risk of QE is that it contributes to asset price inflation and rising inequality which is exactly why in most countries across Europe populist regimes on the rise today. In order get into power populist leaders will make big, unrealistic promises. Promises they can only hope to fulfill by printing more âworthless moneyâ.

3. Hard Asset Buffer Against Uncertainty

While âworthlessâ paper money or âfiat currenciesâ being burned on a pier of populism, hard or tangible assets with intrinsic value is gaining popularity in capital markets. I know that sounds trite, but when the whole world is centered on debt and financed on promises, there is a very clear reason to have an interest in an asset which is no one's liability.

In the following section, the paper will and highlight the 5 major demand determinants of hard assets and reasons why these form of assets thrive during times of uncertainty.

i. The âChina Factorâ

Figure 3: China's Appetite for Gold

If that is a picture of the mood in Europe and North America which have been denuded of manufacturing then the beneficiaries of globalization, such as China, are going to do whatever they can to protect themselves and their interests. We are now seeing Asian countries, namely China is stockpiling on various tangible assets such as gold over the last decade (refer Figure 3).

They see a time coming when having âhold-in-your-handâ asset remains incredibly vital to preserve wealth. In this scenario, the natural scenario is for income-generating hard assets look incredibly attractive. With nationalism on the rise, countries like China are further gaining prominence by building aircraft carries as well as a daisy chain of military bases between itself and the Persian Gulf, but slyly under the guise of the Belt and Road programme.

Make no mistake, we haven't even seen the beginning of geopolitical uncertainty and historically that has been favorable for gold. Taking in all of the above, we are looking at a rare and exciting time to start investing in income-generating hard assets.

ii. The second reason you should be interested in hard assets as a âsafe havenâ

When times are good, e names of big-name tech companies like Amazon, Apple and Netflix are on the lips of everyone. As investors, we were more concerned whether Apple or Amazon would get to a US $1 trillion market cap first.

Thus, that is a testament itself to on how popular these mega-cap tech stocks were performing. This also means a lot of value has already been priced in. By comparison, gold is unpopular because it hasn't gone anywhere in years. It is usually when assets are neglected by investors that they become interesting from a value perspective.

iii. The third reason is physical assets is uncorrelated to inflation

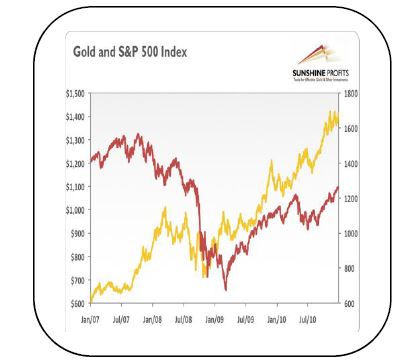

Figure 4; Hard Assets Negatively Correlated with Inflation

That means hard assets doesn't tend to move in tandem with either stocks or bonds and therefore having some in your portfolio offers diversification which is not easily attained from other asset classes.

iv. The fourth reason is hard assets such as gold and silver was once the original money

Despite former Federal Reserve chairman Alan Greenspan referring to it as a âbarbarous relicâ, central banks continue to stockpile hard assets such as gold and it is prized as a store of value in almost every country in the world.

Hence, as investors if we accept the premise that for example, hard assets such as gold or silver is a âstore of valueâ or in other terms a form of âmonetary metalâ. Thus, like any currency, its price will fluctuate relative to other currencies. Just as it makes no sense to say the value of the pound without talking about its value relative to another currency, the same goes for hard assets.

v. The fifth and final reason is hard assets is a physical asset whose supply cannot easily be increased

That gives it particularly attractive characteristics from an investment perspective. That is doubly so when governments are intent on debasing their own currencies.\

There is also the simple fact that hard assets are a âtransportable wealthâ. Thus, these days' investors relate how they love the feel of his hard assets; how reassuringly heavy it is and how it warms up in his hand. There will always be demand for hard assets such as gold, silver and other forms of precious metal, on top of its investment allure.

4. Conclusion

In conclusion, unlike the last crisis in 2008, when governments had the policy tools needed to prevent a free fall, the policymakers who must confront the next downturn will have their hands tied while overall debt levels are higher than during the previous crisis. When it comes, the next crisis and recession could be even more severe and prolonged than the last. Thus after reading this article, how many more red flags you need to see? Hence, to preserve your capital while making some decent returns, the ideal portfolio is the one that can keep volatility as low as possible. The trick is to shift into income-generating hard assets, an investment vehicle that can guarantee you to minimize your exposure to the next financial meltdown.

The post Increased Economic Uncertainty Boost Demand for Hard Assets appeared first on Foundation Capital.