China's Construction Equipment Market Flourishing from Trade War with the U.S

A. Introduction

The Chinese government is set to expand infrastructure spending to stimulate the economy amid the growing risk of a slump as its trade war with the U.S. escalates.

Figure 1: Number of Airports in China Expanding

(Source: Global Market Insights)

China's state planner, the National Development and Reform Commission (NDRC) has granted permission to construct a US $6.06bn (42.1bn Yuan) expansion project of Urumqi Airport in Xinjiang, western China . Geographically, Urumqi is an important center in China's Belt and Road initiative (BRI) and is an addition to the increasing number of airports across China ⌠Refer Figure 1 above⌡.

To facilitate the various mega-projects across Western China, the NDRC have offered preferential policies to these provinces in terms of capital input, investment environment, internal and external opening-up, development of science and education, and human resources. At the same time, an additional 12 key projects is in the midst of construction across Western China in 2018.

The sole intention of China to increase its public investment on projects such as the Urumqi Airport in Xinjiang, would serve as an economic stimulus that enables China to recover quickly from the possible negative impact from the trade war with the US. Thus, Beijing aims to support its economic growth by boosting domestic demand through constructing the Urumqi Airport in Xinjiang.

B. China's Construction Sector to Boom

During the last few years, China has been investing heavily to strengthen infrastructure across its western provinces which in-turn has boosted its construction and heavy machinery sectors. For example, the construction of the Urumqi Airport in Xinjiang is scheduled to run through to 2030 and China's construction sector is forecasted to grow 4% per-annum from these mega-projects.

The new terminal in Xinjiang is predicted to manage 750,000t of cargo and 63 million passengers per annum and include two additional runways. In a statement released by the NDRC, the Urumqi Airport in Xinjiang will help accommodate the faster growth in aviation sector across western China, notably Xinjiang . Furthermore, it is expected to increase the growth of a global aviation hub along the BRI route.

However, it's interesting to note that the budget for constructing Urumqi Airport is only half of what is going to be spent on China's new mega-airport project known as Daxing International Airport in Beijing. This airport is expected to cost a staggering US $11.53bn (80bn Yuan) and will serve more than 72 million travelers a year by 2025 . At present, the Urumqi Airport operates flights to and from Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, Russia, and the UAE .

C. China's Machinery Sector Posed to Grow

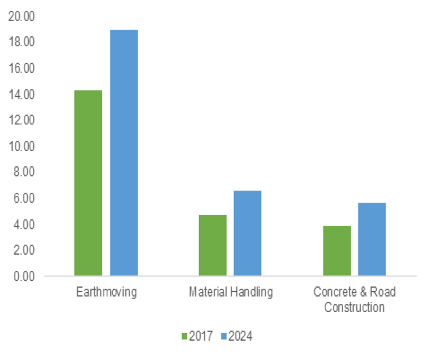

Figure 2: Equipment Demand Spiking in China

(Source: China Industrial Survey)

China's voracious appetite for industrial and construction machinery extends beyond conventional construction tools to encompass machine tools and construction equipment (refer Figure 2 above). Shipments of building equipment to China skyrocketed to 270% April 2018 as public works construction soars in that country ahead of the National Congress of the Communist Party in the fall .

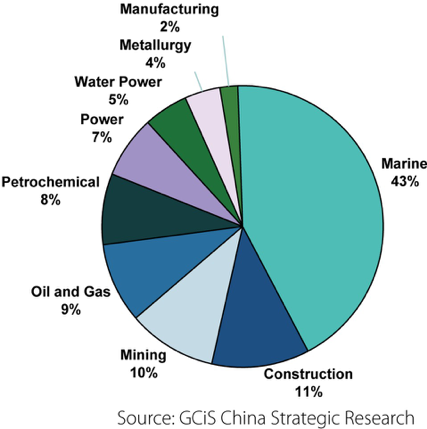

Figure 3: Demand Various Sectors in China

(Source: China Strategic Research)

Meanwhile, industrial and construction equipment builders likely will enjoy robust demand in various sectors in China for a while (refer Figure 3 above). As Chinese construction projects under the BRI initiative demand will continue to rise for high-performance industrial equipment and construction machine tools.

At present, orders for industrial and construction equipment has expanded 24.4% on the year in May 2018 for a sixth straight year . These industrial equipment tools is projected to support the current upheaval in Chinese airports construction, which previously focused on labour to make large quantities of products.

The industrial and construction market is viewed by experts to supporting long-term changes in the Chinese economy as these equipment will help ensure speed and safety amid a market shortage . Ever since the US-China trade war begun in early June of this year, industrial and construction equipment sales in China rose 12% , propelled by rising demand to feed the construction sector.

D. Concluding Remarks

An immediate outcome from the on-going US-China trade on the industrial and construction equipment market within China is the sudden attractiveness of both the renting and leasing sub-sectors . The main reason for this trend could be due to the significant cost inflation in most emerging economies including China over the past few years.

To conclude, all these various multi-billion dollar, multi-year western China's region development strategy is being pursued with the idea in mind to erase existing political, economic, social and cultural cleavages between east and west. In addition to committing huge resources to this Herculean economic endeavor. Without doubt, the success of the infrastructure projects in China is heavily dependent on the availability of industrial equipment and machinery as means to complete projects and reduce cost.